My Journey from Bankruptcy to 200K

I realized I haven’t shared my full story with you yet. It’s deeply personal, but I hope it inspires those of you who may be going through financial struggles.

After a messy and financially abusive divorce, I had to file for bankruptcy. But for me, it wasn’t just about financial hardship—it was about reclaiming my peace of mind. The journey from bankruptcy to building $200k in savings wasn’t easy. It required discipline, sacrifice, and a lot of patience. However, I learned invaluable lessons that helped me regain control of my finances and achieve financial freedom.

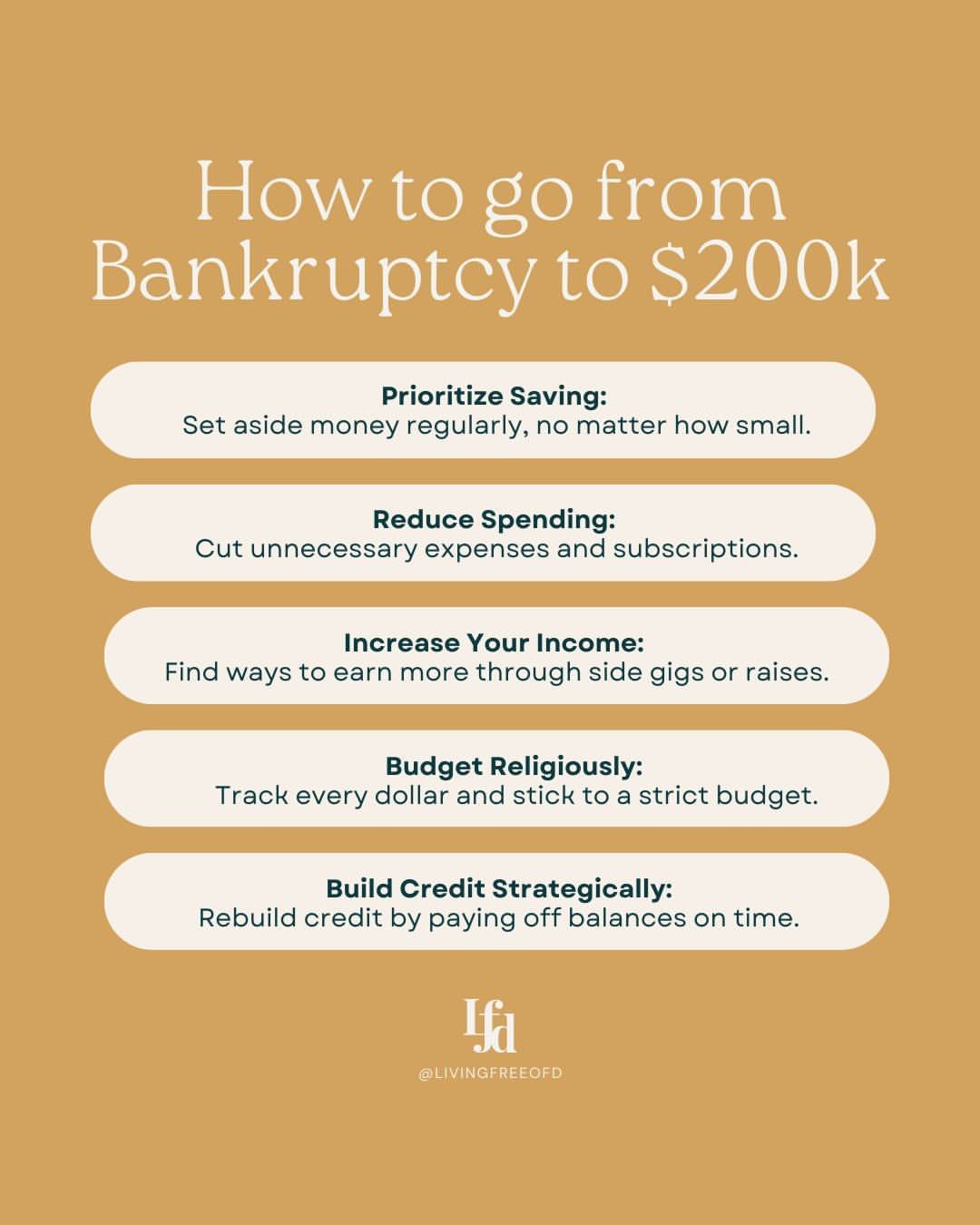

Here are the five key strategies that helped me go from bankruptcy to $200k in savings during my 7-year bankruptcy wait:

instagram @livingfreeofd

01. Prioritize Saving

The first step in my journey from bankruptcy to $200k was making saving a top priority. Even when my financial situation seemed overwhelming, I found ways to set aside small amounts of money. Budgeting became my lifeline—I tracked every penny that came in and allocated it intentionally. Saving doesn’t have to be about setting aside large amounts; it’s about consistency. Over time, those small savings added up, bringing me closer to my financial goals.

02. Reduce Spending

Cutting back on unnecessary expenses was crucial in building my savings. During my journey from bankruptcy to $200k, I focused on reducing subscriptions, avoiding impulse shopping, and being mindful about every dollar spent. Thrift stores became my go-to for affordable purchases, and I only bought groceries on sale to make my money stretch further. These small sacrifices allowed me to save more, pushing me closer to financial stability.

03. Increase Your Income

One of the most impactful strategies in my journey from bankruptcy to $200k was increasing my income. I explored side hustles and negotiated raises at work to bring in extra money. Each time I received a raise, I saved the difference, continuing to live on my previous income. This strategy ensured I had more to save and invest, propelling me toward my financial goals.

04. Budget Consistently

Budgeting was essential throughout this journey. I tracked every dollar and maintained a strict budget, ensuring I stayed in control of my finances. Even though I followed a strict budget, I didn’t completely deprive myself. I still treated myself occasionally, like going out to eat once a month—always with a coupon or during promotions. This balance allowed me to stay focused while still enjoying life’s little pleasures, contributing to my success from bankruptcy to $200k.

05. Build Credit Strategically

Rebuilding my credit was a key part of regaining financial freedom. After bankruptcy, I carefully worked on paying off my credit card balances in full each month. Every 1.5 years, I applied for a new credit card to strengthen my credit score. I also regularly reviewed my credit reports to ensure all bankruptcy-related items were removed. This approach not only helped me rebuild my credit but also contributed to my overall financial health and stability.

Books I’ve read & recommend

Patience is Key

If there’s one thing my journey from bankruptcy to $200k taught me, it’s the importance of patience. I didn’t travel for years and avoided unnecessary purchases. Staying committed to my long-term goals and being patient with the process was absolutely crucial to reaching this financial milestone. My family admires what I’ve accomplished, but I always remind them it took a lot of sacrifices to get here.

Once I hit $100k, the next $25k came from investment gains. They say the first $100k is the hardest, and I can confirm that’s true! But after reaching that point, my investments started working for me, accelerating my path from bankruptcy to $200k.

Final Thoughts

My journey from bankruptcy to $200k was long and filled with challenges, but with discipline, determination, and patience, I was able to turn things around. Whether you’re facing financial difficulties or simply looking to improve your savings habits, remember that with the right strategies and mindset, anything is possible.

If I can do it, so can you!

Follow my journey and get daily financial tips and tricks on Instagram @livingfreeofd

Photo by Katt Yukawa on Unsplash

Note: This page contains affiliate links. I earn a commission if you make a purchase through these links, at no extra cost to you.I only recommend products I genuinely love and use myself.

0 Comments